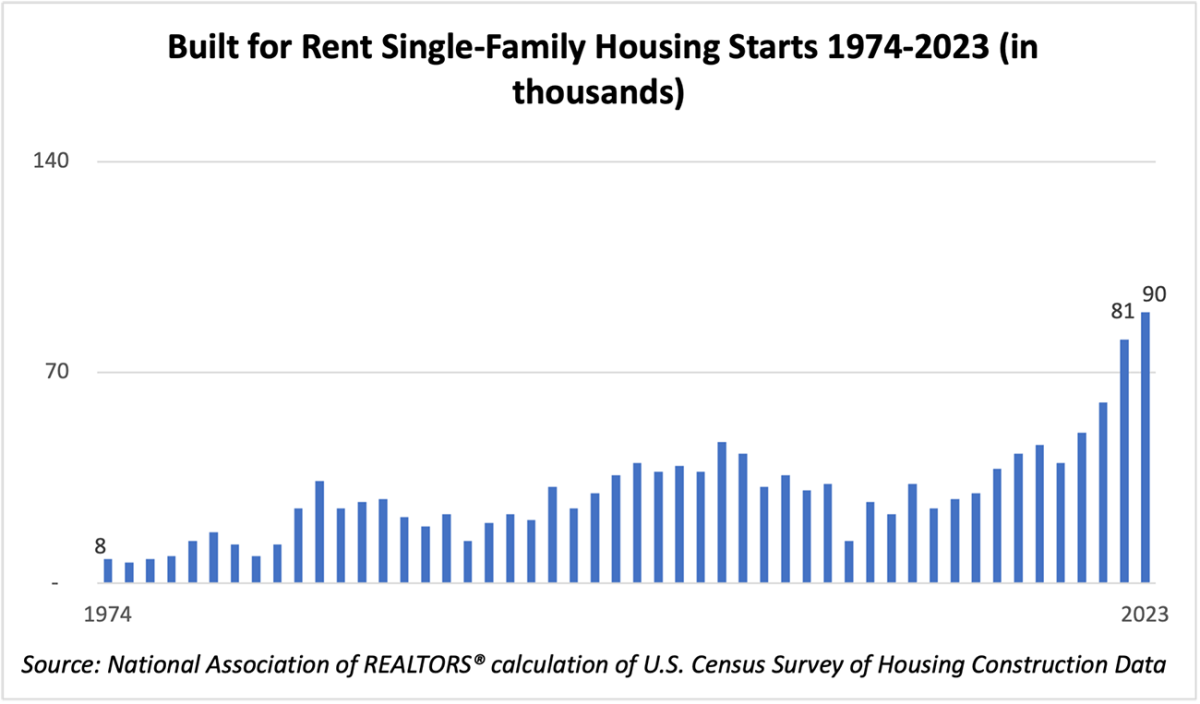

Built-for-Rent Housing Starts Continue to Increase

There is no question that the housing market is in a gridlock, with homeowners unable or unwilling to move due to low-interest rate mortgages. The need for new construction is one solution to this problem, which could alleviate the housing inventory crisis. At the same time, there is a shortage of i

Read MoreA Hidden Gem in the Heart of the City: Discover the Exquisite 100 E 11th St #33

$1,233 2 Beds | 3 Baths | 1,234 SqFt 100 E 11th St #33, New York, NY 10003-5302 Pending When it comes to real estate, New York City is renowned for its high prices and competitive market. However, every now and then, a hidden gem appears, offering the perfect blend of affordability, location, and ch

Read More-

jjjjjjjjjjjjjj

Read More -

gggg

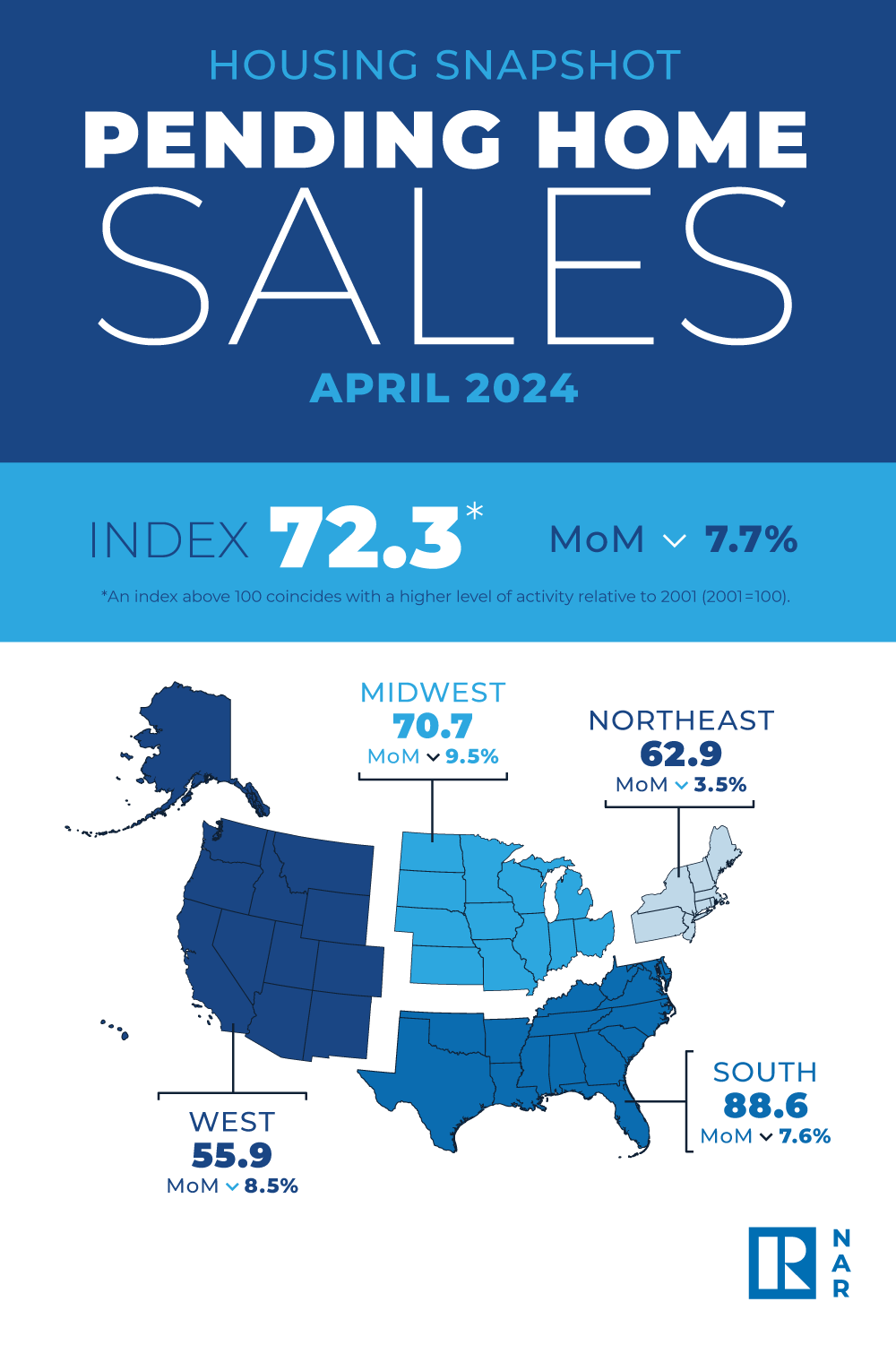

Read More Pending Sales in April 2024 Decreased 7.7% From March

NAR released a summary of pending home sales data showing that April’s pending home sales fell 7.7% from last month and decreased 7.4% from a year ago. " data-src="https://cdn.nar.realtor/sites/default/files/styles/inline_paragraph_image/public/economists-outlook-pending-home-sales-april-2023-to-apr

Read MoreInstant Reaction: Mortgage Rates, May 30, 2024

Facts: The 30-year fixed mortgage rate from Freddie Mac rose to 7.03% over the last week from 6.94%. At 7.03%, with 20% down, a mortgage payment on the median-priced existing home of $407,600 is $2,176. The typical first-time buyer had a downpayment of 8% last year—with this downpayment, the monthly

Read MorePending Home Sales Slumped 7.7% in April

Key Highlights Pending home sales decreased 7.7% in April. Contract signings retreated in all regions compared to the previous month and one year ago. The Midwest and West experienced the largest monthly declines. " data-src="https://www.nar.realtor/sites/default/files/styles/inline_paragraph_image/

Read MoreInstant Reaction: Mortgage Rates, May 23, 2024

Facts: The 30-year fixed mortgage rate from Freddie Mac averaged 6.94% over the last week. At this rate, with 20% down, a mortgage payment on the median-priced $433,500 new home is $2,293, and $407,600 on an existing home is $2,156. Positive: Mortgage rates eased and are now below 7%. This helps buy

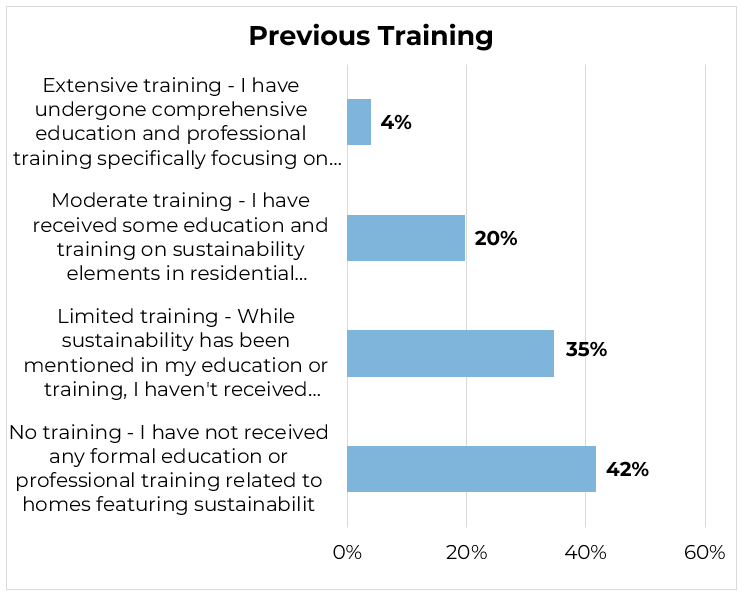

Read MoreUnveiling the Greener Future: Insights from the 2024 Sustainability Survey - Residential

In March 2024, the National Association of REALTORS® conducted a survey to determine the state of the housing market regarding sustainability. The study's results suggest that the industry is right at the beginning of a "green revolution." Green Data Fields: Illuminating Sustainable Features Four in

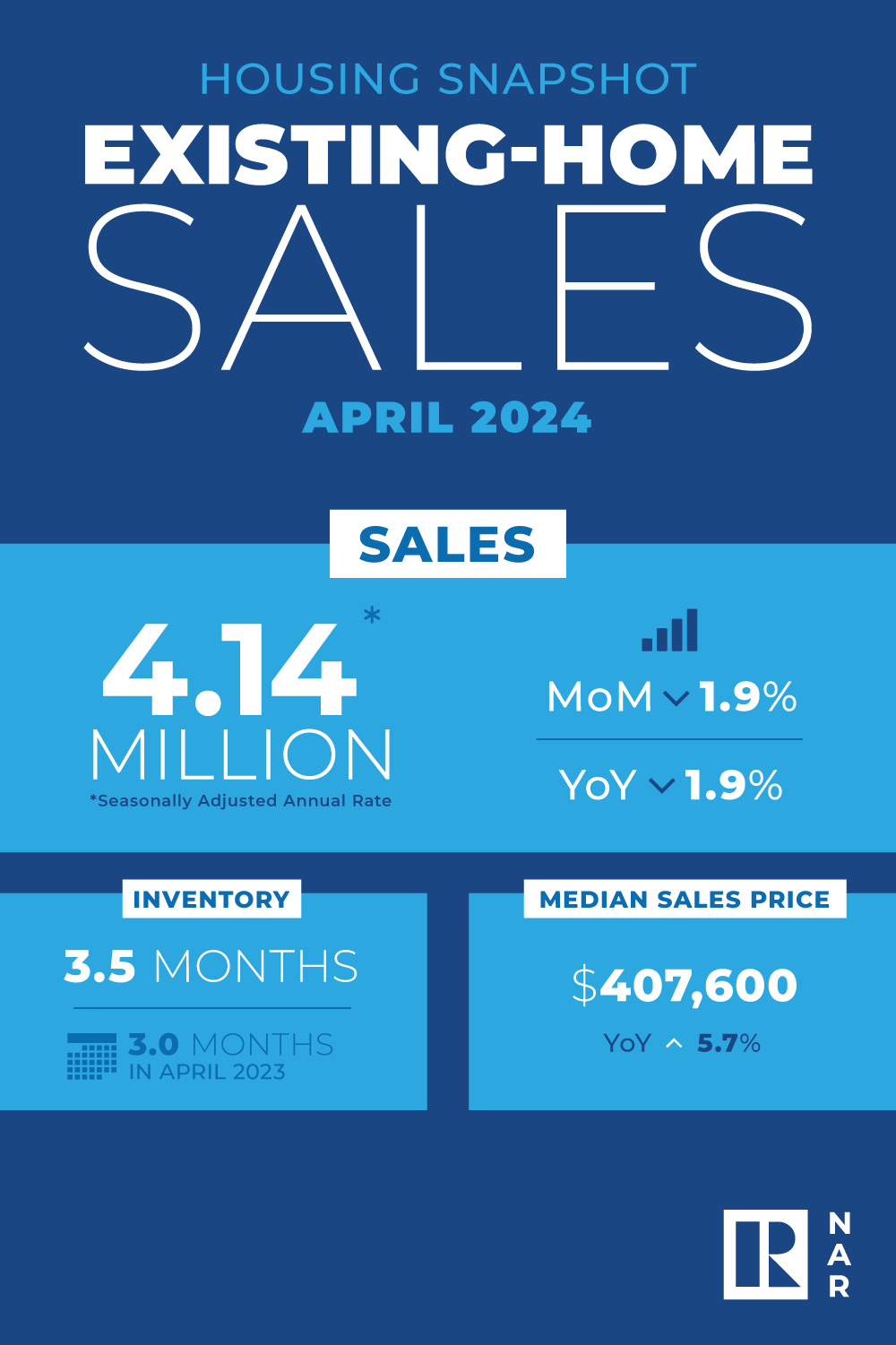

Read MoreApril 2024 Existing-Home Sales Take a Step Back

NAR released a summary of existing-home sales data showing that housing market activity this April declined 1.9% from March 2024. April’s existing-home sales reached a 4.14 million seasonally adjusted annual rate. April sales of existing homes declined 1.9% from April 2023. " data-src="https://cdn.n

Read MoreExisting-Home Sales Retreated 1.9% in April

Key Highlights Existing-home sales faded 1.9% in April to a seasonally adjusted annual rate of 4.14 million. Sales also dipped 1.9% from one year ago. The median existing-home sales price grew 5.7% from April 2023 to $407,600 – the tenth consecutive month of year-over-year price gains and the highes

Read More-

" data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-04-foot-traffic-sentrilock-home-showings-report-cover-05-22-2024-300w-400h.png?itok=HK9pYGRj" class="b-lazy" width="200" height="267" alt="Cover of the April 2024 SentriLock Home Showings report" title="Cover o

Read More The Nation's Most Popular and Fastest Growing Metropolitan Areas in 2023

Please note: The Tableau data visualization embeds on this page are best viewed on a laptop or desktop computer. A recently published update to the U.S. Census Bureau's population estimates allows NAR to examine population dynamics, including how natural change and net migration contribute to growth

Read MoreInstant Reaction: Mortgage Rates, May 16, 2024

Depending on one's outlook, mortgage rates from Freddie Mac today are either a bright spot or a weak spot. Fact: the 30-year fixed mortgage interest rate averaged 7.02% over the last week. At 7.02%, a mortgage payment on a $400,000 home with 10% down is $2,400 and $2,133 with 20% down. Positive: Mor

Read More-

aaa

Read More -

WORK WORK WORK WORK WORK

Read More -

Kobe 4 Life: A Tribute to the MVP, Black MambaKobe Bryant, the Black Mamba, is undoubtedly one of the greatest basketball players of all time. With an illustrious career spanning two decades, Kobe left an indelible mark on the game and in the hearts of his fans. As we celebrate his legacy, it's only

Read More A Gem in Mayfair West: Explore the Comforts of 3466 Friendship Street, Philadelphia

$275,000 3 Beds | 2 Baths | 1,472 SqFt 3466 FRIENDSHIP ST, Philadelphia, PA 19149 Active Are you looking for a charming and well-maintained home in the heart of Philadelphia? Look no further than 3466 Friendship Street in the desirable Mayfair West neighborhood. This spacious row home offers not onl

Read More6666666 Listing Price: Is This San Francisco Property Worth the Hype?

$6,666,666 6 Beds | 400 Baths | - SqFt San Jose Ave, San Francisco, CA 94110 Active The real estate industry is full of surprises, and the latest buzz is all about the San Jose Ave listing in San Francisco, California. This property has created quite the stir, with its listing price of $6666666. The

Read MoreStunning Multi-Level Townhome in High Mountain Village

$499,000 2 Beds | 2.5 Baths | - SqFt 39 Tanager Ct, Wayne Twp., NJ 07470 Under Contract Looking for a luxurious and spacious townhome in Wayne Twp., NJ? Look no further than 39 Tanager Ct, a multi-level property with stunning features and amenities that are sure to impress.As soon as you step inside

Read More

Categories

Recent Posts