-

testyfx334668990

Read More Instant Reaction: Jobs, September 6, 2024

The net monthly job addition averaged 116,000 from 3 months to August. That is light. It even suggests the possibility of turning net negative in the upcoming months if the economy hits an unexpected speed bump. The softening job figures suggest that the Federal Reserve will cut interest rates in mi

Read More-

34yfrtyy

Read More -

aaaaaaaaaaaaaaaaaa

Read More -

2025/02/24

Read More -

The Home Mortgage Disclosure Act (HMDA) provides detailed information on mortgage lending activity, offering valuable insight into housing demand. Data on the number of loan applications can indicate whether housing demand is strong or weak, while approval rates reflect individuals' and families' ab

Read More Instant Reaction: Mortgage Rates, September 5, 2024

Facts: The average 30-year fixed mortgage rate from Freddie Mac remained unchanged at 6.35% this week from last week. At 6.35%, with 20% down, a monthly mortgage payment on a home with a price of $400,000 is $1,991. With 10% down, the typical payment would be $2,240. Positive: Although mortgage rate

Read MoreAugust 2024 Commercial Real Estate Market Insights

" data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-08-commercial-real-estate-market-insights-report-cover-08-29-2024-300w-433h.png?itok=KWg2tmuY" class="b-lazy" width="200" height="289" alt="Cover of the August 2024 Commercial Real Estate Market Insights report

Read MoreInstant Reaction: Mortgage Rates, August 29, 2024

Facts: The average 30-year fixed mortgage rate from Freddie Mac dropped to 6.35% this week from 6.46% last week. At 6.35%, with 20% down, a monthly mortgage payment on a home with a price of $400,000 is $1,991. With 10% down, the typical payment would be $2,240. Positive: This is the lowest that mor

Read MorePending Home Sales Dropped 5.5% in July

Key Highlights Pending home sales fell 5.5% in July. Month over month, contract signings declined in all four U.S. regions. Compared to one year ago, pending home sales increased in the Northeast but decreased in the Midwest, South and West. WASHINGTON (August 29, 2024) – Pending home sales in Jul

Read MoreTrends in Housing Affordability: Who Can Currently Afford to Buy a Home?

Housing affordability has long been a critical issue in the housing market, affecting individuals, families, and entire communities. While the challenges associated with affording a home are not new, they have remained one of the main concerns in the housing market, particularly as higher mortgage r

Read More-

" data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-07-foot-traffic-sentrilock-home-showings-report-cover-08-22-2024-300w-400h.png?itok=mCOyAq4p" class="b-lazy" width="200" height="267" alt="Cover of the July 2024 Foot Traffic NAR Sentrilock Home Showings report

Read More Existing-Home Sales Advanced 1.3% in July, Ending Four-Month Skid

Key Highlights Existing-home sales grew 1.3% in July to a seasonally adjusted annual rate of 3.95 million, stopping a four-month sales decline that began in March. However, sales slipped 2.5% from one year ago. The median existing-home sales price elevated 4.2% from July 2023 to $422,600, the 13th c

Read MoreWhat Is "Demure and Mindful" to Real Estate? Let's Look at First-time Buyers

No one likes jumping on a social media bandwagon more than NAR Research. So, by way of a recent meme, let's go! Looking at the data, let's focus on first-time buyers. First-time buyers have to be "demure and mindful" in many ways. Finances Housing affordability is a struggle, with current high home

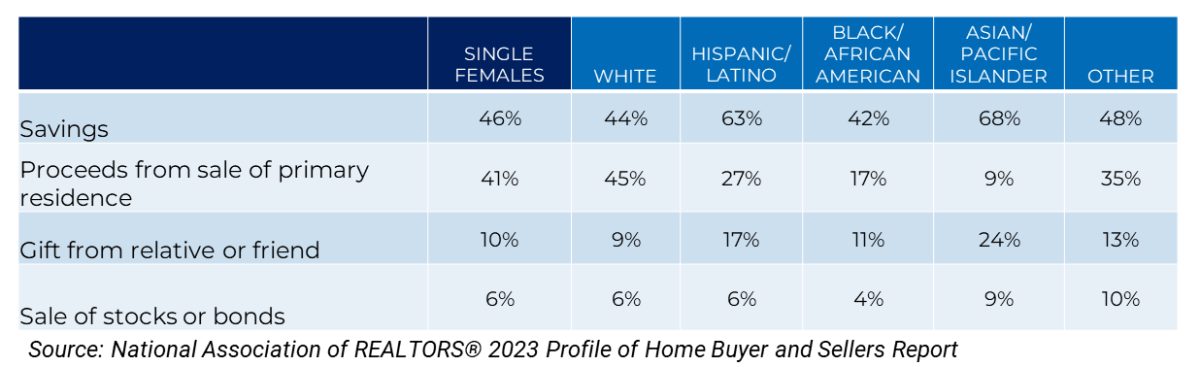

Read MoreFrom Savings to Student Loans: The Financial Realities of Single Female Home Buyers

This past March, celebrating Women’s History Month, we published a blog post exploring the triumphs and challenges of female homeownership. Women of color often face systemic barriers, like limited access to good education, job opportunities, and affordable housing, that are rooted in both historica

Read MoreInstant Reaction: Mortgage Rates, August 15, 2024

Facts: The 30-year fixed mortgage rate from Freddie Mac remained essentially flat at 6.49% this week compared to 6.47% last week. At 6.49%, with 20% down, a monthly mortgage payment on a home with a price of $400,000 is $2,021. With 10% down, the typical payment would be $2,273. Positive: Despite we

Read MoreFresh Faces, New Perspectives: Diversity Among New REALTORS® in 2024

The real estate world is always evolving, and the National Association of REALTORS® (NAR) members are right in the middle of it. This year's 2024 Member Profile has some intriguing findings, especially about the diversity among newer members. One notable highlight is that new members are more divers

Read MoreInstant Reaction: CPI, August 14, 2024

Inflation is calmer, thereby setting the Fed Reserve up to start the rate-cutting process in September. Consumer prices rose by 2.9% in July and look to head towards the desired 2% in a few months. The Fed has indicated the need to normalize and move away from the current “restrictive” monetary poli

Read MoreSingle-Family Home Prices Had Positive Price Gains in 89% of 223 Metro Areas in Q2 2024

The National Association of REALTORS® reported that home prices continued to rise in the second quarter of 2024. National median prices rose 4.9% year over year to $422,100, and median home prices rose by 8.5% compared to the previous quarter. Of the 223 metro areas, 13% had double-digit year-over-y

Read MoreMortgage Rates Decline, but Median Home Prices Rise in June 2024

At the national level, housing affordability fell modestly in June compared to the previous month, according to NAR’s Housing Affordability Index. The monthly mortgage payment increased by 1.0% compared to the prior month, while the median price of single-family homes increased by 2.4%. The monthly

Read More

- 1

- 2

- 3

- 4

- 5

- ...

- 7

Categories

Recent Posts