-

Key Highlights Brokerage specialists had a lower sales volume ($2.5 million vs. $3.4 million), and the typical agent had fewer transactions (10 vs. 12) in 2023 compared to 2022. Seventy-three percent of REALTORS® plan to remain in the real estate industry for at least two mo

Read More Instant Reaction: Mortgage Rates, July 03, 2024

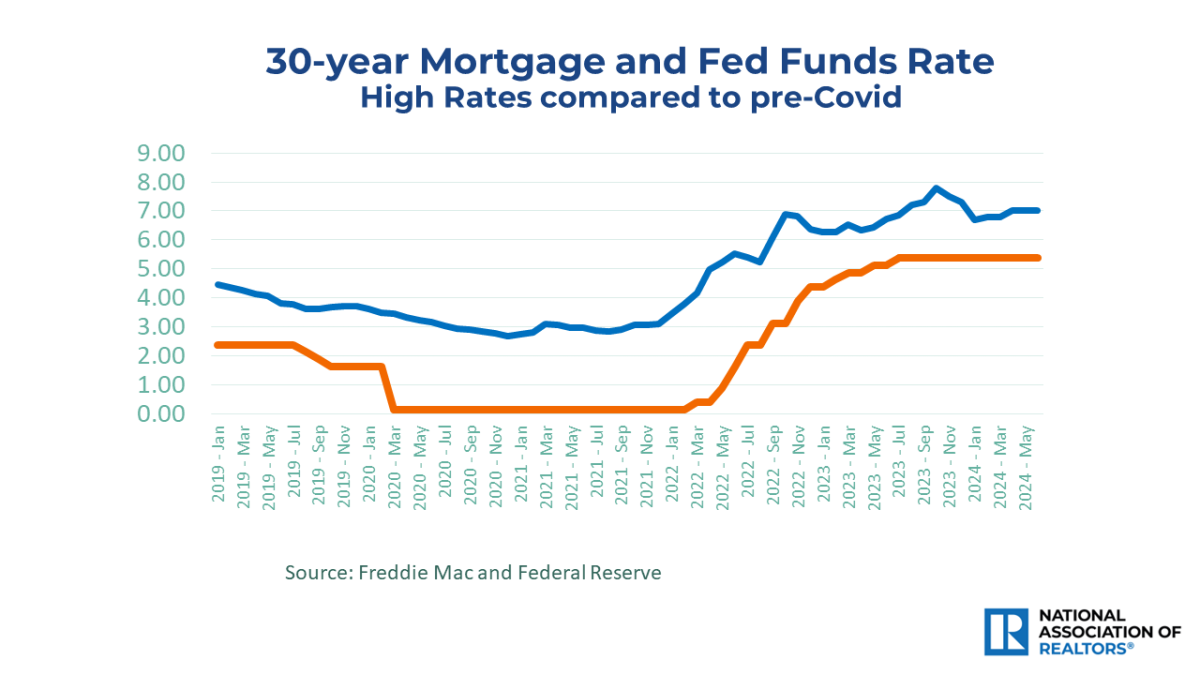

Facts: The 30-year fixed mortgage rate from Freddie Mac increased to 6.95% over the last week from 6.86%. This is the first weekly increase since May 30. At 6.95%, with 20% down, a monthly mortgage payment on a home of $400,000 is $2,118. Positive: While mortgage rates increased this week and af

Read MoreJune 2024 Commercial Real Estate Market Insights

" data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-06-commercial-real-estate-market-insights-report-cover-07-02-2024-300w-434h.png?itok=l7MvEWzP" class="b-lazy" width="200" height="289" alt="Cover of the June 2024 Commercial Real Estate

Read MorePending Sales in May 2024 Hit a New Low

NAR released a summary of pending home sales data showing that May’s pending home sales fell 2.1% from last month and decreased 6.6% from a year ago. " data-src="https://cdn.nar.realtor/sites/default/files/styles/inline_paragraph_image/public/economists-outlook-pending-home

Read MorePending Home Sales Dropped 2.1% in May

Key Highlights Pending home sales decreased 2.1% in May. Month over month, contract signings declined in the Midwest and South but increased in the Northeast and West. Compared to one year ago, pending home sales declined in all U.S. regions.

Read MoreExisting-Home Sales Edged Lower by 0.7% in May as Median Sales Price Reached Record High of $419,300

Key Highlights Existing-home sales slipped 0.7% in May to a seasonally adjusted annual rate of 4.11 million. Sales descended 2.8% from one year ago. The median existing-home sales price jumped 5.8% from May 2023 to $419,300 – the highest price ever recorded and the eleventh

Read MoreInstant Reaction: Mortgage Rates, June 20, 2024

Facts: The 30-year fixed mortgage rate from Freddie Mac continued with small incremental declines to 6.87% over the last week from 6.95%. At 6.87%, with 20% down, a mortgage payment on the median-priced existing home of $400,000 is $2,101. Last year, the median downpayment for a first-time buyer w

Read MoreMarch 2024 NAR Real Estate Forecast Summit: Commercial Update

Watch the Video Recording Presentation Slides " data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-03-07-nar-real-estate-forecast-summit-lawrence-yun-presentation-slides-cover-03-07-2024-1300w-731h.png?it

Read MoreMetro Areas Producing More Housing Than Their Historical Average

by NAR Research staff Understanding Trends in Single-Family Building Permits Across Metro Areas The housing market has always been one of the main drivers of our country's economic activity. Limited housing supply is one of the main reasons behind rising home prices, declining affordability, a

Read MoreMortgage Rates and Higher Home Prices Continue to Hinder Affordability in April 2024

At the national level, housing affordability faded in April compared to the previous month, according to NAR’s Housing Affordability Index. Compared to the prior month, the monthly mortgage payment increased by 5.7%, while the median price of single-family homes increased by 0.1%. The monthly mort

Read MoreInstant Reaction: CPI, June 12, 2024

Inflation is moving in the right direction, but it is not quite at the point for the Fed to cut interest rates. The all-important consumer price inflation rose by 3.3% from a year ago. “Core” inflation decelerated to 3.4%, its slowest gain in three years. The target is 2% inflation. The recent pea

Read MoreServing the REALTOR® Community for 100+ Years

“This is where our history lives. This is where our future lives.” Since 1923, the Library & Archives has been dedicated to providing NAR’s members with resources and services to help them stay at the forefront of real estate knowledge. a#white-header:hover{color: white;

Read MoreEssential Insights Into Industry Trends With Elizabeth Mendenhall

Elizabeth Mendenhall, 2018 NAR President, explains how she used the Library & Archives to help inform a Strategic Planning Committee project and recommends its services to her new agents to gain an edge in the business. a#white-header:hover{color: white; background-color

Read MoreInstant Reaction: Jobs, June 7, 2024

Job additions are continuing at a healthy clip. A net of 272,000 payroll jobs were added to the economy in May, which is an acceleration from recent months. However, unemployment ticked higher, to 4.0%, due to a different measurement showing a net 408,000 jobs having disappeared when based on a ho

Read MoreUS Pending Home Sales Gauge Slumps in April to Four-Year Low –Bloomberg News

Bloomberg News A gauge of pending U.S. existing-home sales tumbled to a four-year low in April as higher mortgage rates cast a pall on the spring selling season. An index of contract signings from the National Association of REALTORS® dropped 7.7% to 72.3, the lowest reading since the early mo

Read MoreInstant Reaction: Mortgage Rates, June 6, 2024

Facts: The 30-year fixed mortgage rate from Freddie Mac eased slightly to 6.99% over the last week from 7.03%. At 6.99%, with 20% down, a mortgage payment on the median-priced existing home of $400,000 is $2,127. In the most expensive MSA of San Jose-Sunnyvale-Santa Clara, CA (median price of $1,8

Read MoreMay 2024 Commercial Real Estate Market Insights

" data-src="https://cdn.nar.realtor/sites/default/files/styles/wysiwyg_small2/public/2024-05-commercial-real-estate-market-insights-report-cover-06-03-2024-300w-433h.png?itok=h-KjEsOQ" class="b-lazy" width="200" height="289" alt="Cover of the May 2024 Commercial Real Estate M

Read MoreConsumer Price Index: The Full Picture?

It's been three years since the United States began facing its highest inflation surge since 1981, which peaked at 9.1% in mid-2022. Although progress has been made in reducing the inflation rate through increased interest rates, the latest Consumer Price Index (CPI) report, which tracks the annua

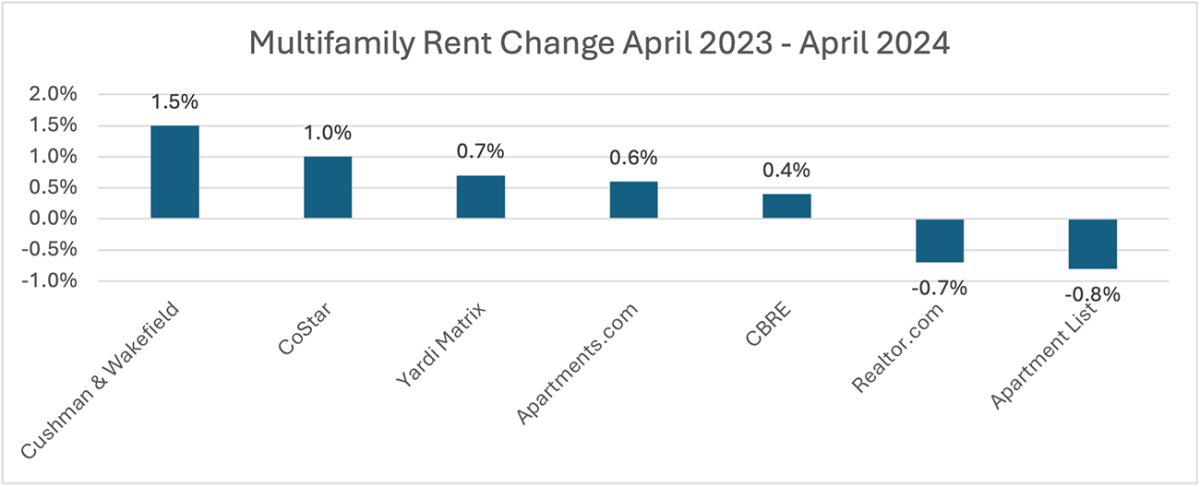

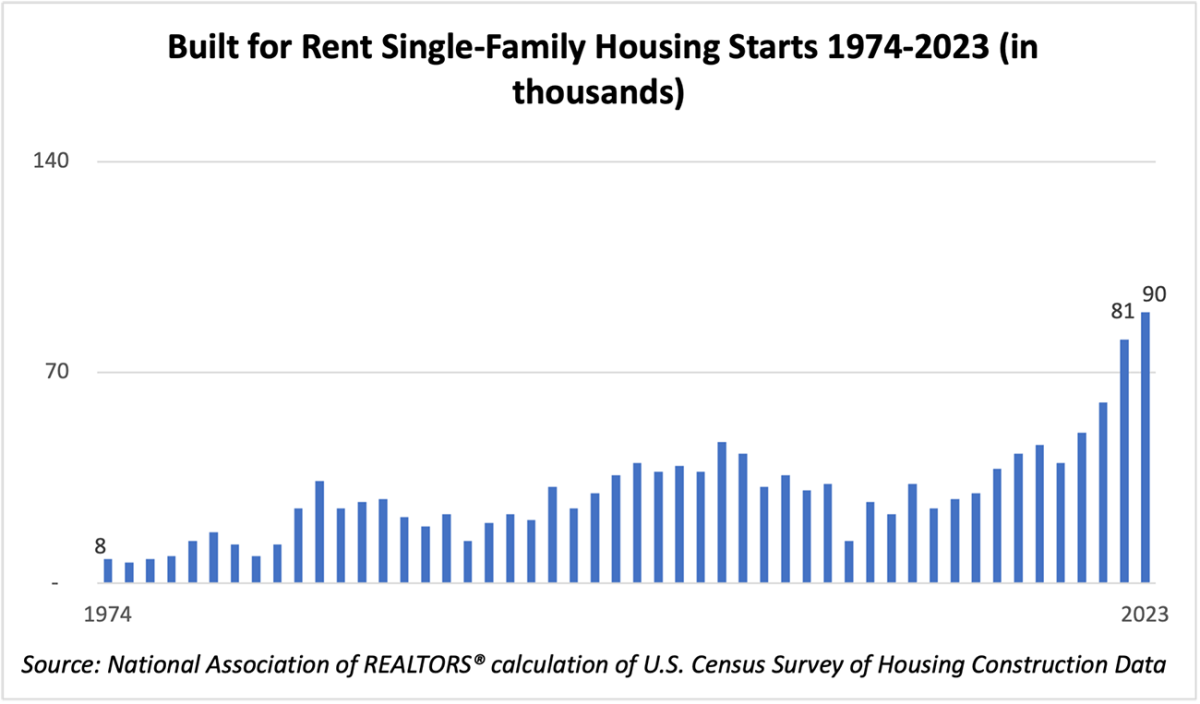

Read MoreBuilt-for-Rent Housing Starts Continue to Increase

There is no question that the housing market is in a gridlock, with homeowners unable or unwilling to move due to low-interest rate mortgages. The need for new construction is one solution to this problem, which could alleviate the housing inventory crisis. At the same time, there is a shortage of

Read MoreA Hidden Gem in the Heart of the City: Discover the Exquisite 100 E 11th St #33

When it comes to real estate, New York City is renowned for its high prices and competitive market. However, every now and then, a hidden gem appears, offering the perfect blend of affordability, location, and charm. 100 E 11th St #33 is one such treasure, nestled in the vibrant neighborhood of East

Read More

Categories

Recent Posts